Posted on Jan 19, 2021 in Blog

Think you might be ready to buy your first home? Here are seven telltale signs:

1. You’re Tired of Renting

If you’re tired of contributing to your landlord’s financial future instead of your own, it may be time to buy a home. Unlike monthly rental payments, mortgage payments will help you build valuable home equity – a substantial financial asset and a great way to increase your own personal wealth.

Bonus: You’ll also have the freedom to personalize and enjoy your home as you wish (no rental rules or agreements).

2. You’re Ready to Settle

If you’re ready to stay in one home, in one neighbourhood for a minimum of five years, homeownership may be right for you. If you have a secure job and don’t plan on moving to a new city any time soon, buying your own home will allow you to focus on your financial and life goals without having to worry about unexpected rental increases.

3. You’ve Paid Down Your Debts

Lenders assess your ability to afford a mortgage using two main calculations or ratios; your Gross Debt Service Ratio (GDS) and your Total Debt Service Ratio. Simply put, these ratios measure your ability to repay a mortgage loan given your current debts (i.e. credit cards, car payments, student loans, etc.) based on your income. For this reason, you’ll want to ensure you’re as debt-free as possible before seeking a mortgage loan.

See: Calculating GDS / TDS to learn more

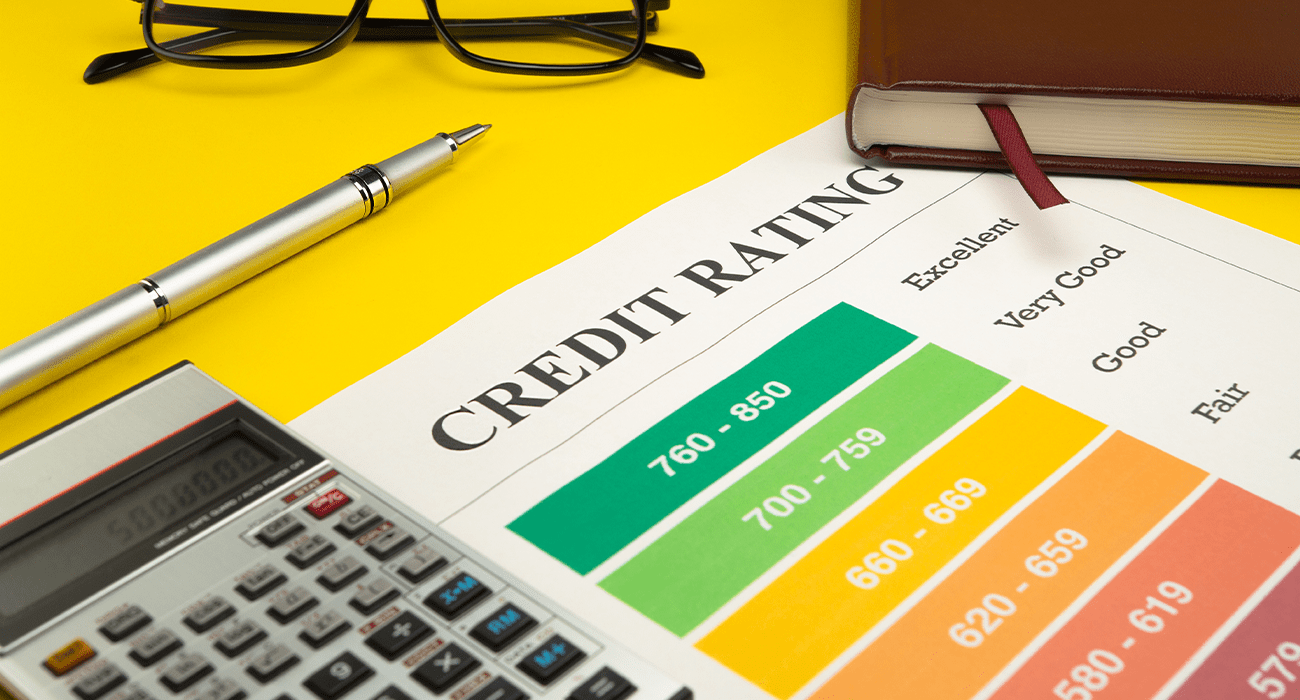

4. You’ve Boosted Your Credit Score

Your credit score is indicative to lenders as to how well you manage your finances. While it doesn’t have to be perfect, the higher your score, the more likely you’ll be to qualify for a mortgage loan at a reasonable rate. In Canada, a credit score of 650 and above is typically considered “good.” Anything below, and you may want to take some time to improve your credit score first.

5. You’ve Saved your Down Payment

To buy a home in Canada, you must be able to put down a minimum of 5% on the home’s overall purchase price. Here too, lenders will also want to see you have your down payment saved before they will issue your mortgage loan. Keep in mind, though, as a first-time buyer, you may qualify for down payment help through various first-time home buyer programs.

6. You Know What You Want

Another key sign you’re ready to buy your first home? You’ve thought about it a lot. You know the area you want to live in, the home style you want (i.e. a single-family home, duplex, etc.), and the number of bedrooms you need. Even better, you’ve compared your new home wants and needs to what you can reasonably afford and are confident proceeding on your new home buying journey.

7. You’ve Been Pre-Approved

Now that you’ve paid down your debts, boosted your credit score, saved your down payment and honed in on what you want (and how much you can afford), it’s time to shop around for a mortgage pre-approval. We do encourage you to shop around as there are a variety of different mortgage products available on the market at different rates.

In short, a mortgage pre-approval is a commitment by a lender to loan you a certain amount for a home at a locked-in interest rate. After careful review of your finances, your lender will (hopefully) issue a pre-approval letter, securing your financing and your ability to purchase within 90-120 days.

You are now officially ready to buy a new home!

Did you know there are plenty of (affordable) perks to buying a brand-new home as a first-time buyer? See our previous post: 6 Reasons Your First Home Should Be a New Construction Home for more information or reach out to us! We’re always happy to help.

Related:

Newly Built vs Previously Owned Homes: The Pros and Cons

How To Choose the Right New Home Builder

Photo credits: shutterstock.com